AGRITECH REVOLUTION

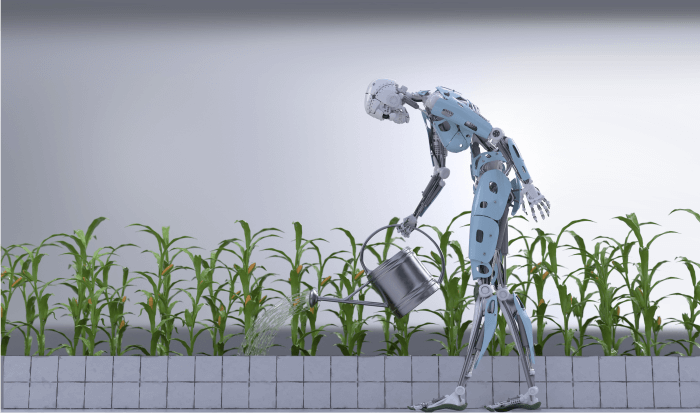

Arable land per capital has decreased by half since 1961 due to rapid population growth, a trend that is poised to persist. The green revolution helped drive yields for cereals in the 1960s, but its effects are now fading. Precision agriculture, as a fully-connected ecosystem, is driving major changes in the industry and might be the solution. Our proposal is, therefore, to build a comprehensive and dynamic exposure to modern agriculture techniques.

Login

Login